With the 52 Week Savings Challenge, you can save over $1,400 in 2023 — starting by just putting away $1 the first week! Find out about the challenge, and get free printables, here.

The concept behind the 52 week savings challenge is pretty simple. You start by saving $1. Next week, you save $2. On and on, adding a dollar until the end of the year.

It’s hard to keep track of in your mind, so a few years ago, I put together a 52 week savings challenge printable. (It’s near the middle of this post.) It’s a printable I like to revive near the beginning of every year since that’s when most people start saving.

This post also has a reverse 52 week savings challenge printable, so you can save more at the beginning of the year and less at the end, when money is tight because of Christmas.

Putting away a few dollars each week will help you save over $1,300 in one year.

Most people will start this 52 Week Savings Challenge at the beginning of the year, making the first week of the year Week 1 and making the last week of the year Week 52.

But honestly, you can start anytime. The first day you put money away starts Week 1. Then, just continue for 52 weeks, whenever that ends.

If you’re seeing this in the middle of January, you can put away a few dollars for the weeks you missed and catch up. But that’s not really necessary. Just start whenever.

Starting is the most important part.

52 Week Savings Challenge

Affiliate links are included in this post and Drugstore Divas may make a small commission if you use them.

Before we get to the printables, let’s go through some information about the money challenge.

52 Week Savings Challenge: Frequently Asked Questions

The 52 Week Savings Challenge is a way to save money. It’s especially great for people who need some sort of schedule to save money, which is why some people refer to it as the 52 Week Savings Plan.

There are two versions of the 52 Week Savings Challenge: a forward and a reverse version, so I broke this post into sections so you could read about each and decide what version is best for you.

For both versions, just print out the appropriate printable below and keep it with your budget.

Then, just follow the schedule for your weekly savings goals.

If you’re following our 52-week challenge, which changes by increments of $1 a week, you’ll save $1,378 over the year.

The $5 savings challenge is different than this one. The 5 dollar savings challenge is that whenever you get a $5 bill, you put it away.

If you use a lot of cash, that can add up quickly. If you don’t use that much cash, that will add up slowly.

The intention of the $5 challenge is not to multiply the dollar a week challenge by five and up your total by $5 increments. In that case, you’d end up adding $260 into savings by Week 52 and honestly, that’s a lot for people.

If you could do that, you’d end up saving $7,000 over the course of the year. But honestly, that’s a big ask for a lot of people.

52 Week Savings Challenge Traditional Version

The traditional 52 Week Savings Challenge is probably the one you’re most familiar with.

If you do the forward 52 Week Savings Challenge, you put away $1 the first week, $2 the next week (Week 2), all the way until you get to $52 during Week 52. That adds up to $1,378 at the end of the challenge, which is a nice chunk of change to have.

The best part about doing the forward version of the 52 Week Savings Challenge is that starting is really easy on your wallet. It’s only $1 to get started.

When you’re starting to save, you probably don’t have a lot of money to save. That’s why you’re starting this savings challenge in the first place. So finding $1 to save isn’t that bad.

52 Week Savings Challenge Printable

The printable for the forward version of the 52 Week Savings Challenge is below.

To use it, just right click the image above and save it to your computer. It’s formatted to print on a sheet of 8.5- x 11-inch paper (standard home printer size).

When you’re ready, print it. To save on ink, you can print it grayscale, but I think it looks prettier in color.

After you’ve put away the money for the week, cross off that week. At the end of the year, every week will be crossed off and you’ll have $1,378 in savings.

Reverse 52 Week Savings Challenge Version

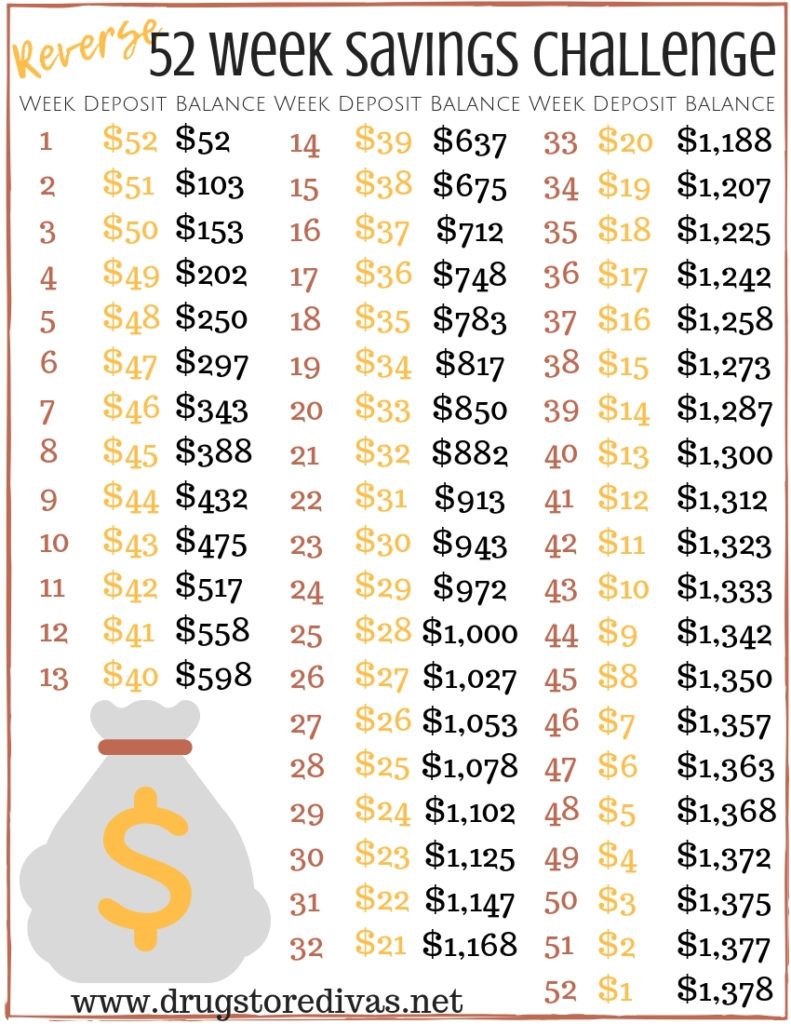

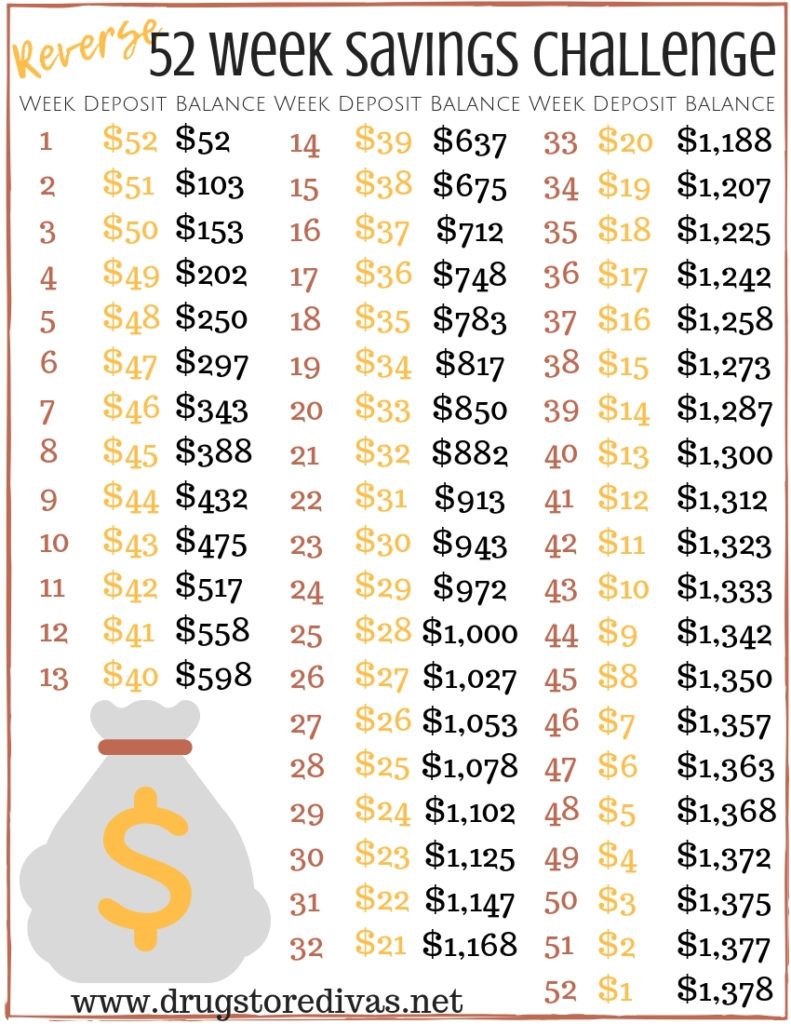

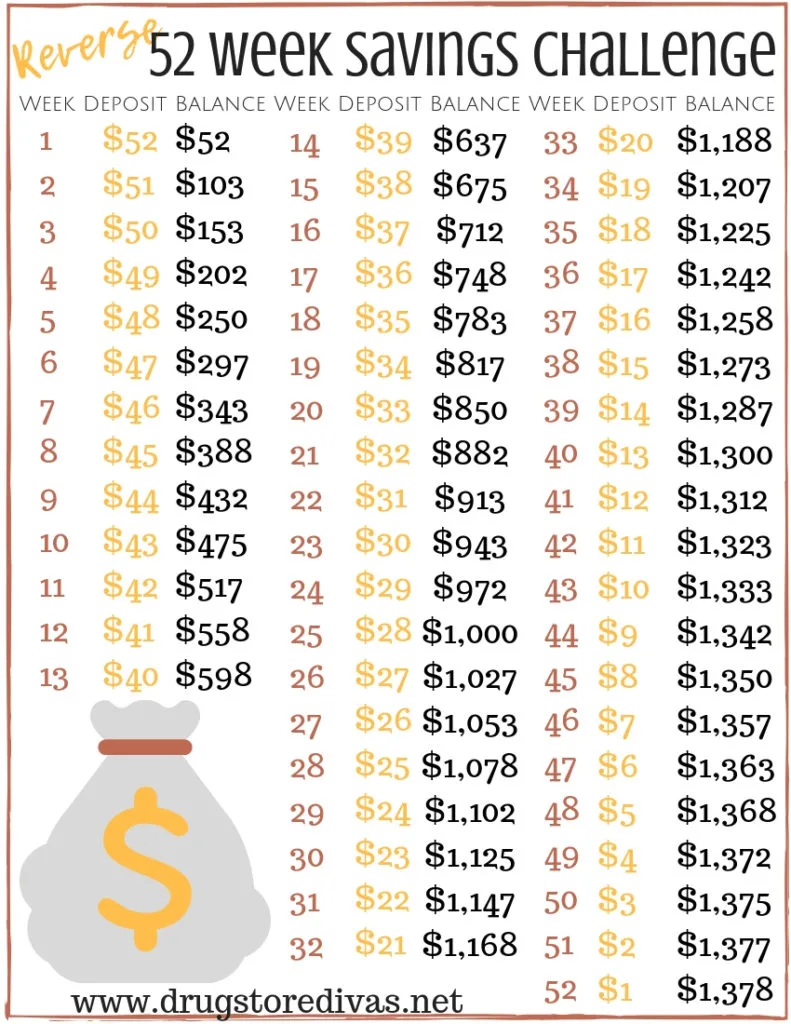

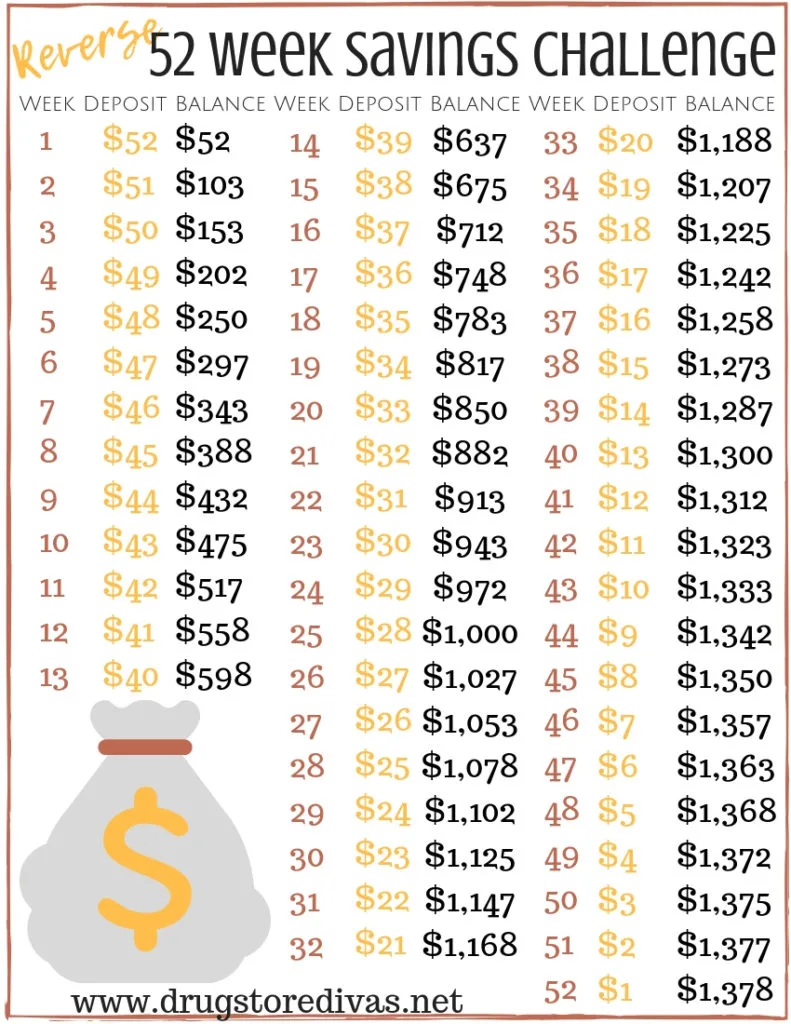

If you do the reverse 52 Week Savings Challenge version, you do the forward challenge … but in reverse.

So you put away $52 during the first week and finish by putting away $1 the last week of the challenge. For people who start in January and have tight budgets at Christmastime, this way is better because you are only putting away single digit amounts of money during the holiday season.

If you’re paying off holiday bills in January, it might be hard for you to find $52 dollars to save though. So you just have to decide what fits better into your budget.

Reverse 52 Week Savings Challenge Free Printable

The reverse 52 Week Savings Challenge printable is below.

To print the schedule, just click on the image, save it to your computer, and print. You can print it in grayscale and fast draft, so you don’t use colored ink.

After you’ve put away the money for the week, cross off that week. At the end of the year, every week will be crossed off and you’ll have $1,378 in savings.

So, no matter which way you do the 52 Week Savings Challenge, you’ll have $1,378 saved after 52 weeks.

52 Week Savings Challenge Version Cherry Picker Version

Some people do a cherry picker version of the 52 Week Savings Challenge. There’s no exact printable for that because it’s sort of willy nilly, so either version’s printable would work.

For this version, you choose any amount that’s left on your list and put that away for the week. So, on Week 1, every amount is available so you can pick $1, $52, or even $35. It doesn’t matter.

Choose any amount from the list, save it, and cross that value off the list. The next week, choose a different value. Continue for 52 weeks until all the values are crossed off.

This is a really good option for people who don’t have a standard paycheck every week. Some jobs can be feast or famine as far as pay goes. So on the weeks you get paid well, you can cross off the higher numbers. And on the weeks that aren’t so well, you can cross off the lower numbers.

The key is just to keep going and not skip a week.

How Drugstore Divas can help you save money

Drugstore Divas is filled with tons of ways to save money all year long. We’ve done posts like that since this blog started in 2009, and we will continue to do that into the future.

We have made changes since we started the blog. We started as a deals and coupon blog back in 2009, posting up to 50 posts in a single day.

In 2017, we started to focus more on ways to live a frugal life rather than ways to get free toothpaste. Saving money is like dieting. You don’t want to just diet, you want a lifestyle change. So we started to do less coupon alerts and more posts about meals you can cook at home so you’re not blowing money on take out.

Since then, we’ve started to incorporate more fun elements, like restaurant reviews and DIY projects, onto Drugstore Divas. We just wanted to remind everyone that you can go out to eat, and you can travel, all while on a budget.

A budget doesn’t mean that you have to pinch pennies and stay home all the time. A budget means that you’re conscious of where those pennies are going.

Of course, we still have coupons and deals, but those are over on our Facebook and Twitter pages, because being frugal is one of the most important characteristics in my work life and personal life.

Tips For Saving Money:

If you’re trying to save more money in the new year, we have a few posts to help you save that will be very useful during the year.

- The Ultimate Guide To Saving Money By Cooking At Home

- 10 Money Saving Tips For When You’re Traveling

- 8 Ways To Save On Winter Home Bills

- 3 Ways To Save $3k (Without Clipping Coupons)

- 8 Ways You Can Save Money on a Daily Basis

Have you tried the 52 Week Savings Challenge before? Let us know how it went in the comments.

Melissa

Thursday 28th of December 2023

I love a good challenge! And 2024 is going to be a minimal year for me. I'm starting it off with a no-spend month in January. 😁

Jennifer Wise

Wednesday 27th of December 2023

Great approach for savings, and I love that you have a printable to go with it as a step-by-step guide.

Snapdragon

Tuesday 26th of December 2023

Interesting. I might give it a shot for 2024.

Lisa Pomerantz

Sunday 20th of January 2019

Back again, and loving this post, from #thatfridaylinky xox

Kim

Sunday 20th of January 2019

My hubby and I have saved for years and are now retired. It’s a very good thing. Because my husband usually takes care of budget, I usually pass right by posts about finances. But, the photo with piggy bank brought back memories of my children. Love this post.